Beginning Monday, September 8, 2025 United Bank's Positive Pay system may be accessed via the mobile app!

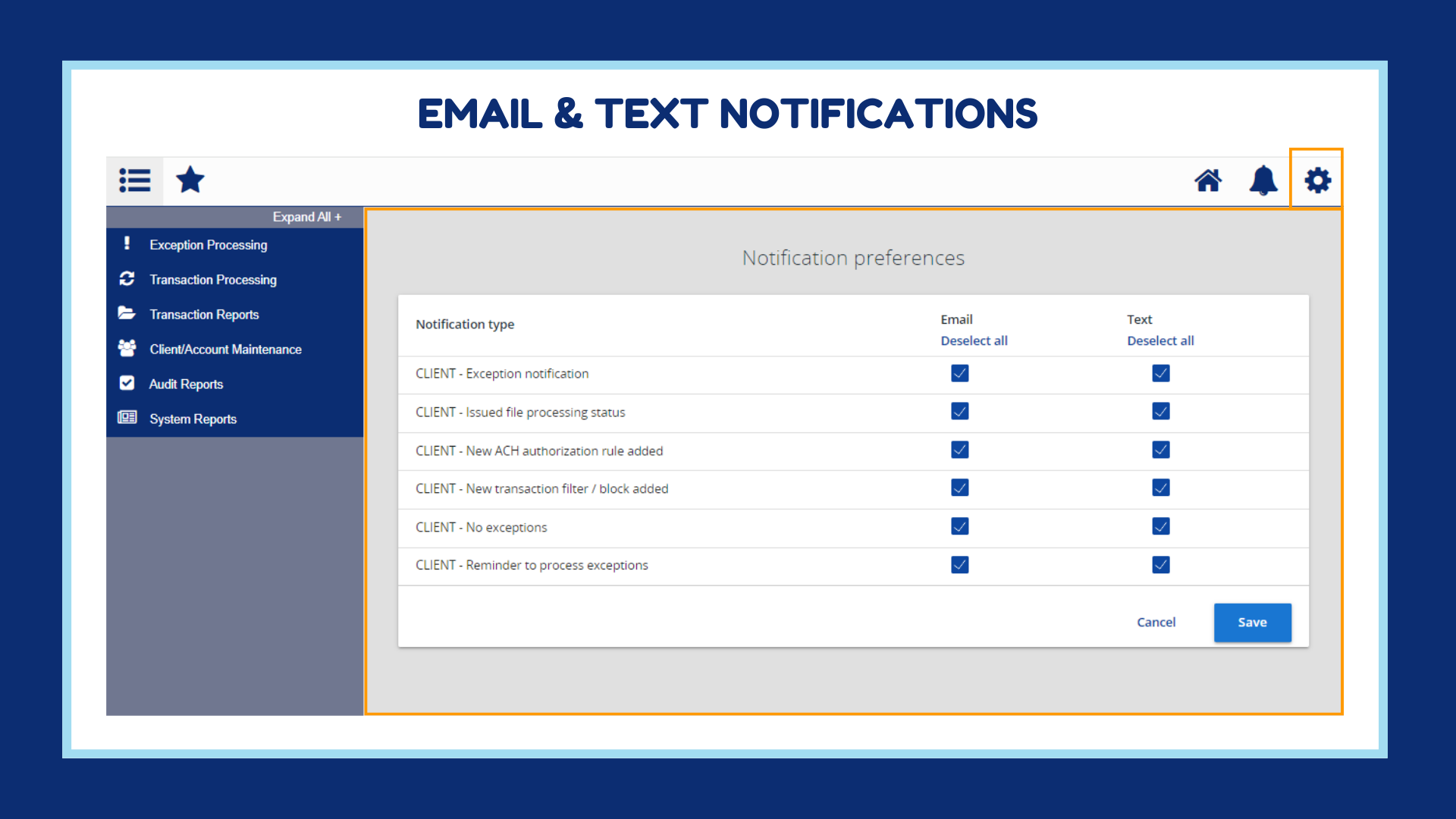

- Email and text notifications when you have exceptions to review and decision

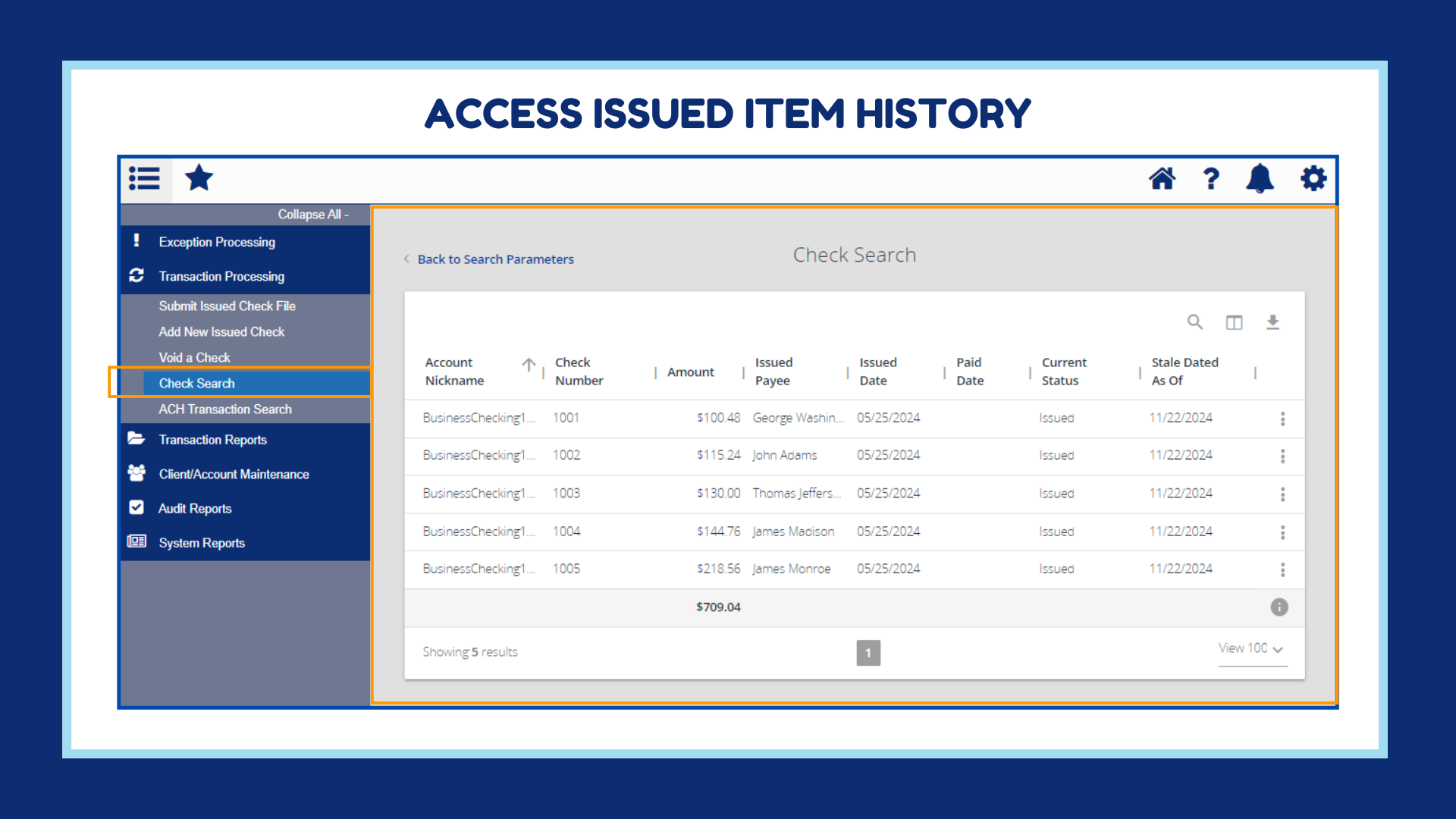

- Access to your previously uploaded issued check files

- Reporting capabilities that include check and exception history

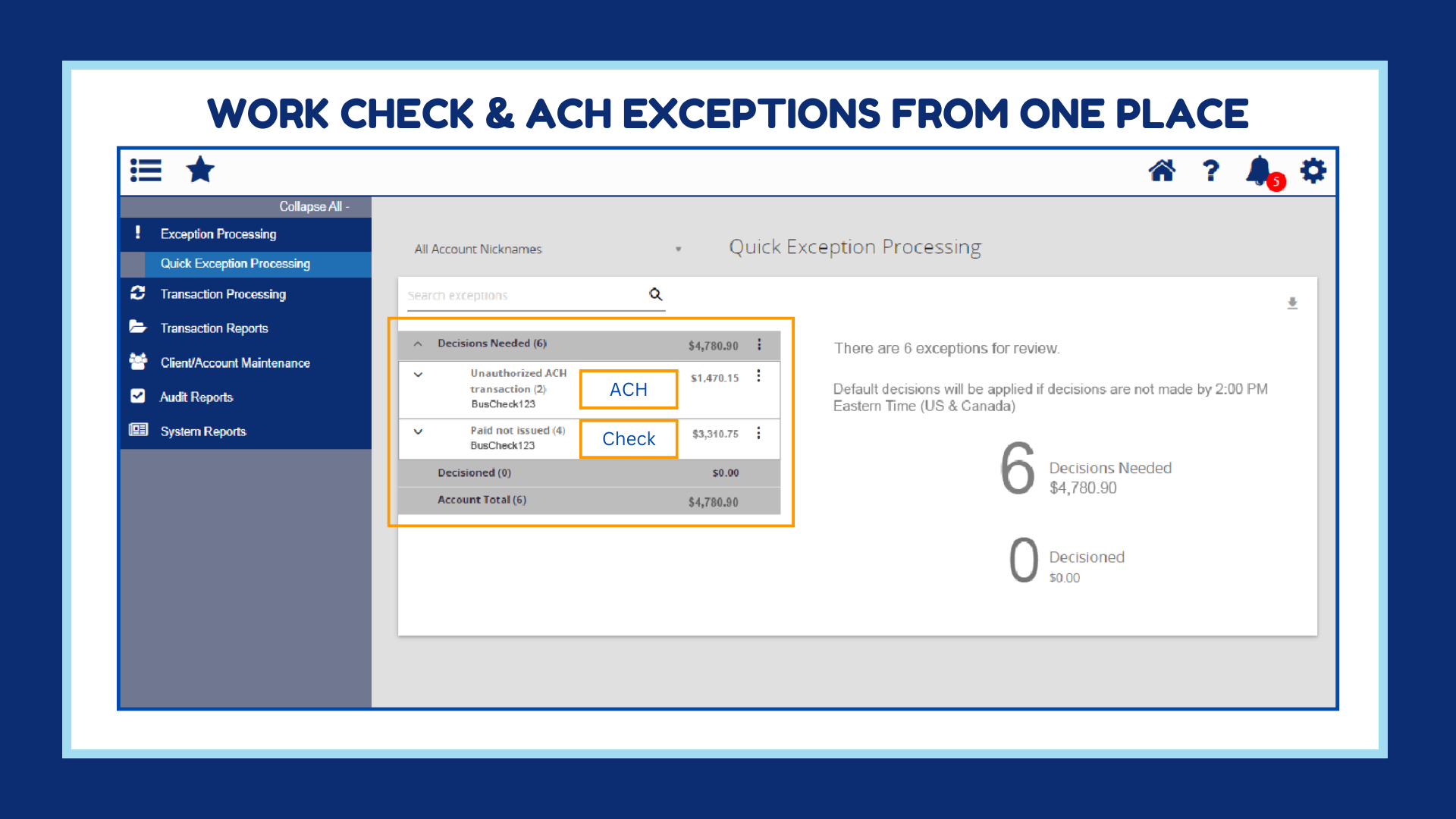

- Single page to view and work both check and ACH exceptions

As a reminder:

- For checks, the system will verify the payee name, check number and check amount.

- For ACH transactions, the system will validate against the filters/rules you allow.

- The timeframe for reviewing your exception items is 5am until 2pm, Monday through Friday.

- Any unworked exception items will be automatically returned.

- For the best results, we strongly encourage you to upload/enter your check file information each time you issue checks.

What is Positive Pay?

Positive Pay is a fraud prevention tool which can be added to your Cash Management access that monitors debits that post your accounts. There are two components:

- Check Positive Pay compares those posted items to an issued check register that you upload to determine if the item is safe to “pay”.

- ACH Positive Pay monitors electronic debits that post by comparing them to a list of rules you create based on the details of the ACH originators.

Posted items that do not match your check register or ACH rules are kicked out as exceptions to review. You are able to review the exceptions and make pay or return decisions between the hours of 5a-2p M-F through your Cash Management Access.

Can I utilize Positive Pay if I have never experienced fraud?

Yes! We encourage all businesses to take advantage of the fraud protection that Positive Pay offers. Contact our Business Services department today to secure your accounts!

Can I upload my issued check file at any time?

Yes! Upload items anytime of the day and as many times as needed. If an item is already posted to the account, the item would need to be uploaded before 8pm in order for the information to be available for compare during business day processing.

Can I upload an item the same day it posts to my account?

Yes! If you notice that a check has memo posted to your account (showing as a pending transaction), you can upload the issued check information for that item any time before 8pm for the check to be reviewed in Payee Match. If the information is not uploaded before 8pm, it may appear as a “Paid No Issue” exception after business day processing.

Can I have the ability to review every debit that posts?

Yes! This is referred to as Reverse Positive Pay. We can set up a transaction filter on the account to kick every check or ACH debit out as an exception for review. This allows you upload your check information in order for United Bank personnel to verify any checks that are presented in-house while still having the ability to review every debit that posts.

Can I be reminded if I have not worked my exceptions?

Yes! You can opt into text or email notifications to be sent two hours before the cutoff time (2pm) if exceptions have not been worked. Reminder notifications will not be sent on holidays or non business days.

Can I delete or edit an issued item if the information is wrong?

Yes! You can edit the information of an uploaded item if it is still in the “issued” status. You can also void or delete an item if the check is no longer being sent to the payee.

Can I have multiple users with different responsibilities?

Yes! User permissions can be customized to fit your business’s responsibility structure. If you want certain users to have limited access to Positive Pay, such as only exception processing or only uploading issued items, you can reach out to a Business Services Specialist and they can assist you in allocating responsibility amongst your users.

Can my users work Positive Pay for only specific accounts?

Yes, we can adjust each user’s account access. For example, if you have multiple business entities with different employees for each, we can make sure each user only sees and has the ability to work positive pay for the appropriate accounts.

Can I change a decision in an item?

Yes, you are able to adjust decisions on a worked exception as long as it is before the 2pm cutoff. All worked exceptions will remain visible in the “Decisioned” tab within Positive Pay until the 2pm cutoff.

Do I have to work exceptions on the weekend and/or holidays?

No! Any exception items that appear through the weekend or on a holiday listed below will carry over to the following banking day where normal processing deadlines will apply.

- New Year’s Day (January 1)*

- Martin Luther King Jr. Day

- Presidents’ Day

- Memorial Day

- Juneteenth (June 19)*

- Independence Day (July 4)*

- Labor Day

- Columbus Day

- Veterans Day (November 11)*

- Thanksgiving Day

- Christmas Eve Day (Subject to early closure)

- Christmas Day (December 25)*

- Weekends (Saturdays and Sundays)

*If January 1, June 19, July 4, November 11, or December 25 fall on a Sunday, the holiday will be observed on the following Monday.

How quickly can Positive Pay be put on my account?

It usually takes our team 1-3 banking days from the time paperwork is signed to activate Positive Pay on your account. We train any users who will be working the service and provide resources to help you get the most out of the service!

What are “False Exceptions” and how can I minimize them?

False exceptions occur when an item that is safe to pay is presented as an exception because there was either no information uploaded, or the information was different or incomplete than what was printed on the check.

Make sure you always upload any issued checks you send out to prevent “Not issued” exceptions.

For “Payee Mismatch” exceptions, you can review the information displayed in the Positive Pay “Quick Exception Processing” page to learn and adjust your future issued checks accordingly. You can also refer to the “Best Tips and Practices” guide to ensure that your check formatting will yield a more confident read in Payee Match.

When should I return an item?

You should always return items that you notice as different than what you issued. You are able to view the front and back image of all exception items to ensure that the information captured represents the payee for which you issued the item. When in doubt, you can return the item and communicate with the payee so that they may anticipate another check.

What happens if an item that is not uploaded is presented at United Bank?

If a payee brings a check from a Positive Pay account to be negotiated by one of our in-branch tellers, at an ITM, or via mobile deposit, and that check cannot be verified as issued in your Positive Pay Check register, United Bank will be unable to negotiate the item. The payee will be advised to reach out to you, the payor, so that the check may be added to the register for processing.